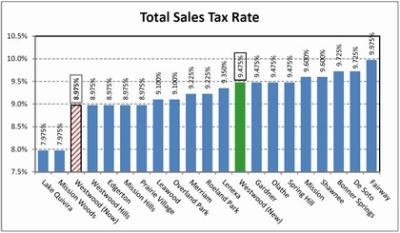

The current sales tax rate in Westwood is 8.975%.

If approved, the new sales tax rate would be 9.475%

|

State Tax |

6.5% |

|

Sate Total: |

6.50% |

|

County - General Tax |

0.5% |

|

|

|

|

County - Public Safety Tax |

0.25% |

|

|

|

|

County - Storm Sewers Tax |

0.10% |

|

|

|

|

County - Public Safety Capital & Operations Tax |

0.25% |

|

|

|

|

County - Education Triangle Tax |

0.125% |

|

|

|

|

County - Courthouse Tax |

0.25% |

|

County Total: |

1.475% |

|

City - General Tax |

1.0% |

|

|

|

|

City – Street & Storm Water Maintenance |

0.5% |

|

City Total: |

1.50% |

|

Total Sales Tax Rate |

9.475% |

|

|

|