Related Questions

Can the city use existing revenues to pay for needed improvements?

While other revenues sources will help pay for these needed repairs, the city can’t responsibly divert additional money away from other budgeted items to cover street and storm water needs without significantly impacting those other services that citizens have said are top priorities.

Mail-In Ballot Election Timeline

Ballots will be mailed to all Westwood registers voters.

- April 10, 2018: Last day to register to vote

- April 11, 2018: JOCO Election Office ballots delivered by mail to Westwood voters

- May 1, 2018: Noon deadline for ballot return to Johnson County Election Office

- October 1, 2018: Sales tax begins (if passed)

What Does the Local Sales Tax Apply To?

The local sales tax is imposed on all retail goods purchased within the corporate limits of the City of Westwood. In addition to goods and items purchased at retail stores, a sales tax is levied against most utility services - like natural gas, electricity, and phone services.

If a Westwood resident spends on average $250 per month on utilities, or $3,000 per year, the proposed new ½-cent sales tax rate would be an additional $15 per year of sales tax, or an additional $1.25 per month.

What options does the city have for revenue to pay for project costs?

The CIP "Pay-as-You-Go" Option:

Continue to budget approximately $200,000 per year, complete projects only as cash is on hand. Downsides: Further delays needed projects, more expensive approach in the long run because construction costs/inflation will increase at a higher rate than the municipal bond interest rate.

Increase the Mill Rate / Property Taxes:

The current FY 2018 Westwood city property tax mill levy is 21.307 mills. For Westwood, 1-mill generates about $25,000 per year.

Increase City Fees:

The current storm water utility fee in Westwood is $1.00 per month, for every 500 square feet of impervious surface area on a property. This fee structure currently generates approximately $96,000 per year, that can only be used for storm water improvements.

Special Retail Sales Tax:

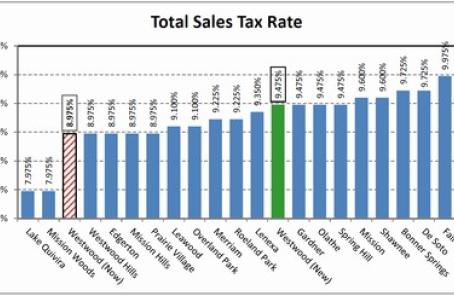

Westwood's current local rate of 1.0% is the lowest municipal sales tax rates in Johnson County. In 2017 it generated about $430,000.

What Will the Mail-In Ballot Say?

Shall the following be adopted? Shall the City of Westwood Kansas be authorized to levy a one-half of one percent (0.5%) special purpose citywide retailers’ sales tax within the City of Westwood, Kansas; such additional tax, if approved by a majority of the electors voting thereon, to take effect on October 1, 2018, or as soon thereafter as permitted by law, and terminate ten (10) years after commencement; the proceeds of which shall be used to pay for, in whole or in part with any other funds, the cost of repairing, rebuilding, rehabilitating, upgrading and improving streets and storm drainage infrastructure in the City of Westwood; such program shall include grading, repair, reconstruction and rehabilitation of curbs, gutters, pavement and other surfacing, driveway entrances and structures, drainage work incidental thereto, service connections from utility mains, conduits or pipes, streetlights, street lighting systems, storm water drains, retaining walls and area walls on public ways or land abutting thereon, sidewalks, street trees and landscaping, storm water drainage projects, and all related improvements, and any financing therefor; and be in addition to the one percent (1%) citywide retailers’ sales tax currently levied within the City?

To vote in favor, vote Yes

To vote against, vote No

Why a special sales tax to fund these needed infrastructure projects?

The city has proposed the ½-cent sales tax to fund the infrastructure projects for several reasons. The City Council has the authority to increase the property tax mil rate, but that rate increase would only apply to Westwood property owners.

Other users of Westwood streets, including the many thousands that live outside Westwood, would not contribute to an increase in the property tax mil levy. In addition, the City Council feels that an issue this important should be the decision of the Westwood voters.

A dedicated special infrastructure sales tax ensures that all money collected must be used ONLY for the infrastructure needs outlined in the ballot.

Why do we need to invest more in street and storm water improvements?

It is projected that at current funding levels it would take decades to accomplish the needed improvements which ultimately would lead to a significantly higher costs.

The City of Westwood has typically budgeted about $200,000 a year for all capital improvement projects

Meanwhile:

- Construction costs will continue to rise;

- Any other projects on the city's "needs to do" list are delayed 10 years or more; and

- Streets will continue to age; the streets in most need have not been significantly upgraded in nearly 50-years.